Mortgage calculator with pmi and closing costs

Many states lenders and mortgage programs have specific rules and guidelines concerning seller closing costs. Also called private mortgage insurance PMI.

Home Loan Downpayment Calculator

This amount will be negotiated once an initial offer is accepted usually after the buyer does a home inspection.

. The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. The cost of PMI varies greatly depending on the provider and the cost of your home.

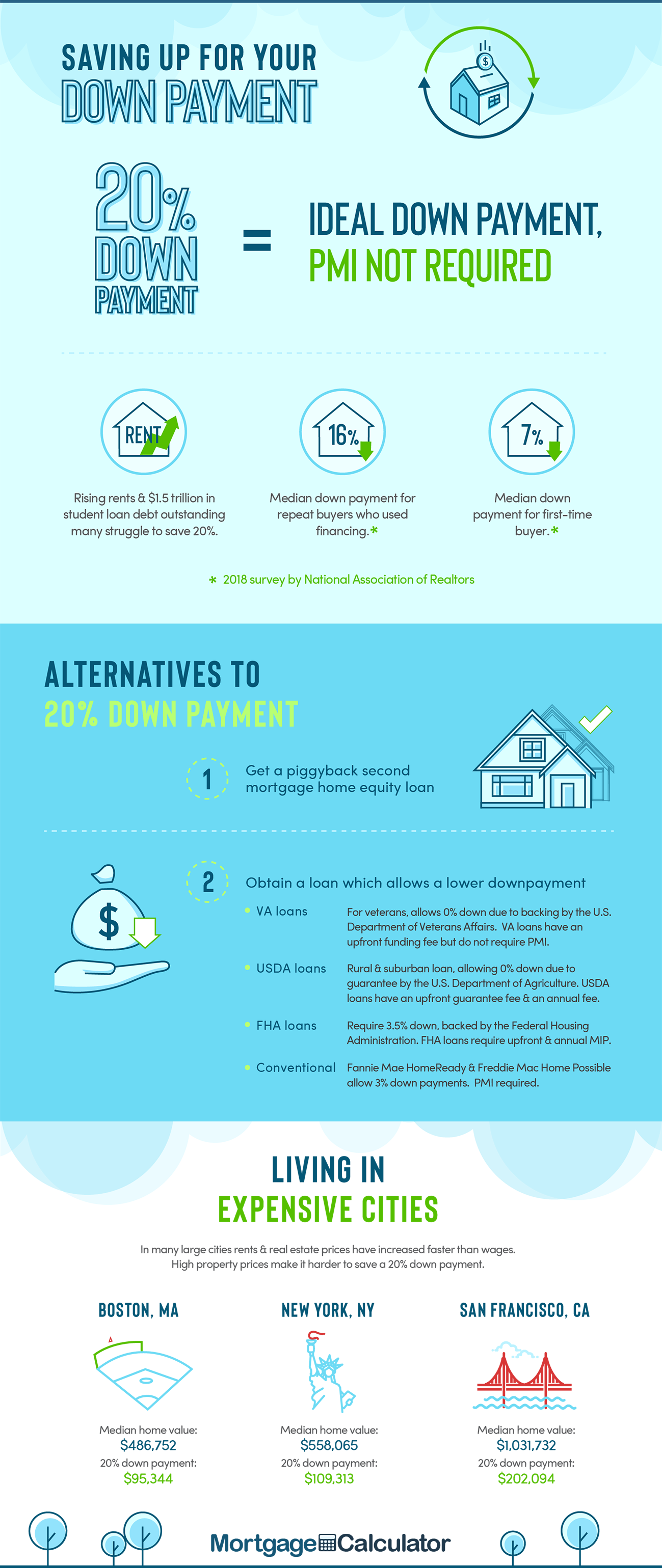

Private mortgage insurance PMI is a type of insurance that conventional mortgage lenders require when homebuyers put down less than 20 percent of the homes purchase price. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the closing costs as a percentage of home value figure. And by working with an agent from Better Real Estate and funding with Better Mortgage youll save 2000 on closing costs and save up to 8200 on average over.

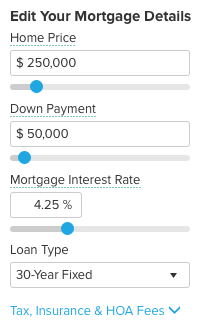

See how changes affect your monthly payment. Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows. Borrowers with small downpayments do have choices available to them outside of the FHA program.

Luckily these fees are only charged once at the closing of the mortgage and dont carry on annually like insurance and property taxes. The figures displayed above are based upon your input and may not reflect your actual mortgage payment or total monthly costs. Improve your credit score.

If you pay less than 20 lenders will expect you to pay PMI as part of your mortgage payment each month. Sources include the US. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

This is how much itll cost you over time to borrow this amount of moneyIn other words this is how much the lender will charge as payment for giving you the mortgage. Closing costs are another expense youll have to consider before buying a home. Census Bureau Bankrate and government websites.

For example a 30-year fixed-rate loan has a term of 30 years. However some lenders have. Most low-down mortgages require a down payment of between 3 - 5 of the property value.

An escrow account may be required to cover the future payments for items like homeowners insurance and property. To avoid paying private mortgage insurance PMI on a conventional loan lenders expect a down payment of at least 20. Choose a longer-term mortgage like a 30-year rather than a 15-year loan.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance. The MIP displayed are based upon FHA guidelines.

In some cases sellers will take on a portion of the closing costs lessening the initial financial burden on buyer. Avoid private mortgage insurance. Unlike most private mortgage insurance PMI policies FHA uses an amortized premium so insurance costs change along with your loan amount.

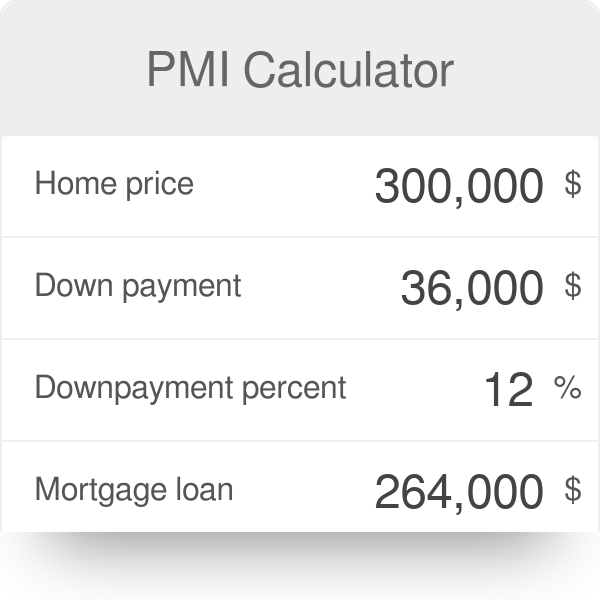

PMI protects the lender in case you default on the loan. See how your monthly payment changes by making updates. PMI costs can range from 05 to 2 of your loan balance per year depending on the size of the down payment and mortgage the loan term and the borrowers credit score.

When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. The calculator allows you to see total mortgage costs including your MIP charges over any time frame you wish.

This mortgage calculator shows your mortgage costs with PMI. Closing coststhe fees paid at the closing of a real estate. Use our mortgage calculator to calculate monthly payment along with Taxes Insurance PMI HOA Extra Payments on your home mortgage loan in the US.

In the US the Federal government created several programs or government sponsored. The greater your risk. Rule of thumb is to plan for 2 to 5 of home price as your estimated closing costs.

Try to avoid PMI private mortgage insurance if you can. Private mortgage insurance PMI. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

PMI short for private mortgage insurance helps homebuyers qualify for a mortgage without making a 20 down payment. Use this closing costs calculator to estimate your total closing expenses on your home mortgage including prepaid items third-party fees and escrow account funds. About 2-5 percent of the loan amount depending on your home price and lender.

A guide to better understanding closing costs is. Private Mortgage Insurance PMI is calculated only if down payment is less than 20 of the property value ie loan-to-value ratio is higher than 80 and stops as soon as the outstanding. A down payment is a percentage of the entire loan amount you pay upfront before closing on the mortgage.

FHA also charges an upfront mortgage insurance fee. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. The third tab shows current Boydton mortgage rates to help you estimate payments and find a local lender.

On average to cover closing costs for a home in Texas youll need to save around 217 of the purchase price. Put 20 down or as much as you can for your down payment. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. FHA loan closing costs are close to conventional closing costs. This is the total amount youre financing including the purchase price of the home minus any down payment and sometimes closing costs or other fees.

Other loan programs are available. The Loan term is the period of time during which a loan must be repaid. Mortgage programs which require a minimal down payment.

Pmi Mortgage Insurance Calculator 2022 Casaplorer

Hidden Costs Of Buying A Home Home Buying Buying Your First Home Home Buying Process

Mortgage Calculator With Closing Costs Hot Sale 51 Off Www Ingeniovirtual Com

Mortgage Calculator With Closing Costs Online 50 Off Www Ingeniovirtual Com

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Real Estate Education Home Buying

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Pin On My First Place

Mortgage Calculator With Closing Costs Hot Sale 51 Off Www Ingeniovirtual Com

Downloadable Free Mortgage Calculator Tool

Pmi Calculator Mortgage Insurance Calculator

Discount Points Calculator How To Calculate Mortgage Points